Perhitungan Dana Tabarru’ Asuransi Syariah Menggunakan Hukum Mortalita Makeham dengan Metode Cost of Insurance

Abstract

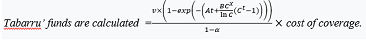

Abstract — Tabarru’ funds in Islamic insurance is a number of funds that are used to help each other between insurance participants. In the fund management mechanism with savings element, Tabarru’ funds have a percentage of payment of 5%. Whereas in the management of funds without savings, it is not known how much the percentage must be paid to the company, so that it will cause confusion for customers. In this research, we will discuss how to calculate the tabarru’ funds using the cost of insurance method. This calculation involves the probability of death based on the Makeham mortality table. Makeham Mortality Tables can be arranged by estimating parameters using the least squares method. obtained parameters A, B and C, respectively for men, namely 0.05822, 0.00158 and 1.08394, while for women namely 0.04418, 0.00152 and 1.08400. So the amount of tabarru’ funds that must be paid by someone aged x that is,

Keywords — Tabarru’ funds, Makeham Mortality Law, Least Squares Method, Cost of Insurance Method

Full Text:

PDFReferences

Suparmin, Asy’ari. 2019. Asuransi Syariah: Konsep Hukum dan Operasionalnya. Jawa Timur: Uwais Inspirasi Indonesia.

Amrin, Abdullah. 2011.Meraih Berkah Melalui Asuransi Syariah. Jakarta: PT Elex Media Komputindo

Jordan, Jr. C.W.1991. Life Contingencies. The Society of Actuarias, Chicago.

Bowers, N.L., Geerber, H.U, Hickman, J.C., Jenes, D.A., dan Nesbit, C.J., 1997, Actuarial Mathematics. Schaumhurg: Society of Actuaries.

Fitria, Amanah.2016.Analisis Dana Tabarru’ Asuransi Jiwa Syariah Menggunakan Perhitungan Metode Cost Of Insurance. Bulletin ilmiah Math. Dan Terapannya. Volume 05, No.1(2016), hal 53-60.

X. Feng, G. He dan Abdurishit. 2008. Estimation of Parameters of The Makeham Distribution Using The Least Squares Method. Mathematics and Computers in simulation, volume 77, no.1, pp (34-44)

DOI: http://dx.doi.org/10.24036/unpjomath.v5i2.8926

3.jpg)